CASH SWEEP VEHICLE DEFINITION MAC

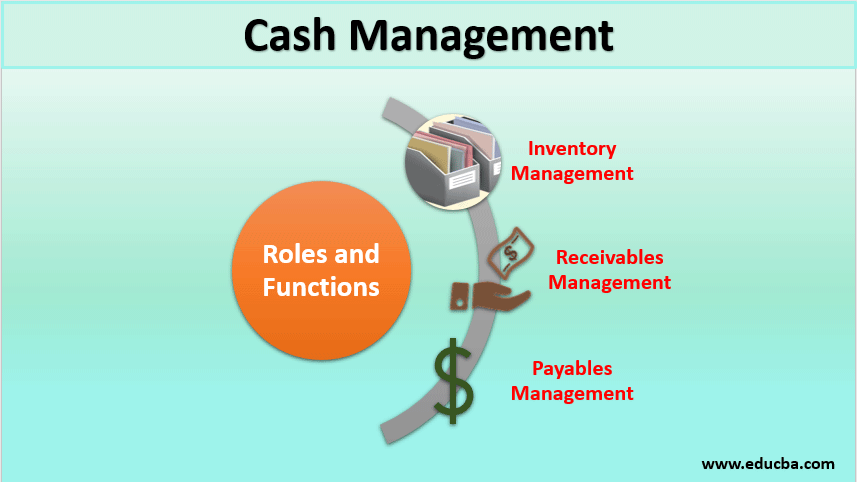

Definition of Material Adverse Change: The MAC clause typically defines what constitutes a material adverse change. Key points about MAC clauses in private equity:ġ. These clauses provide a mechanism for the buyer to potentially back out of a deal if there is a significant negative change in the target company's financial condition or business operations between the signing of the deal and its closing. Material Adverse Change (MAC) clauses are common in private equity transactions. They provide a level of protection for the target company in case the acquirer fails to fulfill its obligations under the agreement. The exact terms and conditions of reverse termination fees can vary widely from one deal to another, and they are an important aspect of deal structuring in private equity transactions. These reasons may include regulatory issues, financing failures, or breaches of representations and warranties. Reverse termination fees are often negotiated as part of the acquisition agreement and are typically triggered if the acquirer fails to complete the transaction for reasons defined in the contract. These fees are paid by the acquirer to the target company and are designed to compensate the target for the time, effort, and expenses incurred during the negotiation and due diligence process, as well as for the opportunity cost of not pursuing other potential deals. In private equity, reverse termination fees, also known as "break-up fees," are fees that a target company may receive from a potential acquirer if a deal does not falls through due to certain specified circumstances. Additionally, cash sweep arrangements are typically outlined in the fund's operating agreement, and investors should carefully review this document to understand how distributions are managed. The decision to implement a cash sweep depends on the fund's investment focus, the nature of the portfolio companies, and the preferences of the fund manager and its investors. It's important to note that not all private equity funds use cash sweep provisions. It may involve returning a certain percentage of excess cash flow to LPs or following predefined periods for distributions. Structure and Terms: The specific terms of a cash sweep provision can vary depending on the fund's structure and investment strategy. It ensures that the fund has sufficient capital to support its investment strategy and maximize returns.ĥ. Balancing Reinvestment and Distributions: The cash sweep helps strike a balance between reinvesting cash into existing or new investments and providing distributions to investors. This process allows LPs to receive returns on their investments.Ĥ. Excess Cash Flow: Once the portfolio companies' cash flow exceeds the set targets or thresholds, the excess cash flow is "swept" and distributed to the limited partners. Instead of distributing all cash flow immediately, the fund manager sets specific targets or thresholds for cash flow from the portfolio companies.ģ.

Distributions to Limited Partners: Private equity funds have limited partners (LPs) who are investors in the fund. These companies generate regular cash flow from their operations, making it feasible to distribute excess cash to investors.Ģ. Mature Companies: Private equity funds that invest in mature companies with stable cash flow are more likely to implement cash sweep provisions. Here's how a cash sweep is typically used in private equity:ġ. It is primarily employed in private equity funds that invest in mature, cash-generating businesses rather than in early-stage ventures. In private equity, a cash sweep is commonly used as a mechanism to manage the distribution of cash flow generated by the underlying portfolio companies.

0 kommentar(er)

0 kommentar(er)